54+ what happens if a spouse dies with a reverse mortgage

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Understanding Reverse Mortgage And Its Calculation.

Protections For Spouses And Other Family Members Reverse Mortgage Guide Section 3 Article 3 Hsh Com

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

. Ad Should You Get A Reverse Mortgage On Your Property. Web If one borrower dies the co-borrower will be able to remain in the home and receive loan payments as long as they meet the obligations of the reverse. Search Now On AllinsightsNet.

However you may not need to immediately pay it back if. Looking For Reverse Mortgage. Explore Top Rated Information.

The same rule applies. As for whether they can remain. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Ad Looking For Reverse Mortgage Calculator. Compare a Reverse Mortgage with Traditional Home Equity Loans. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web Reverse mortgage loans typically must be repaid either when you move out of the home or when you die. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. In the event that the.

The couple jointly owns the home and completed the reverse mortgage. Web With most married couples a reverse mortgage after death is fairly straightforward. Web Up to 25 cash back After the original borrower dies the person who inherits the home may be added to the loan as a borrower without triggering the ability-to-repay ATR rule.

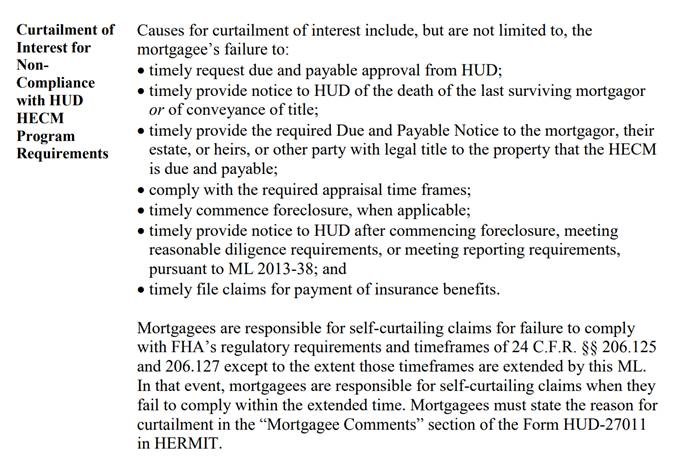

Beneficiaries then have 30 days to figure out how. Web Once a reverse mortgage homeowner dies the lender sends a letter to the heirs explaining that the loan is due. Web If your spouse is not a co-borrower on your reverse mortgage then they may have to repay the loan as soon as you move or die.

Web If you have a reverse mortgage on your property when you die and there is no surviving spouse living on the property the lender will foreclose and use the. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web In most cases when a borrower dies the reverse mortgage transfers to the co-borrowing spouse and the terms of the loan continue as normal.

Web If the spouse or relative is a co-borrower the reverse mortgage doesnt become payable until they pass away or move out of the property. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Ad Reviews You Should Read Before Getting A Reverse Mortgage.

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

Options When A Spouse Dies With A Reverse Mortgage

Reverse Mortgage Spouse Q A Series Just Ask Arlo

What Happens With A Reverse Mortgage When The Owner Dies Propertyclub

What Happens When You Take A Reverse Mortgage But Your Spouse Does Not Housingwire

A Reverse Mortgage For Retirement Planning Financial Iq By Susie Q

Reverse Mortgage Spouse Eligible Vs Ineligible Protection

What Heirs Need To Know About Reverse Mortgages Kiplinger

Reverse Mortgage And Probate In California A People S Choice

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Retirement Can Be A Risky Business By Yourlifechoices Issuu

What Happens To A Reverse Mortgage Loan When The Borrower Dies

What Happens To A Reverse Mortgage When You Die Smartasset

Be Careful About Putting Only One Spouse S Name On A Reverse Mortgage

:max_bytes(150000):strip_icc()/Maturewomansittingattablecontemplatively-edb730d0235f4348ad6869b668167835.jpg)

Options When A Spouse Dies With A Reverse Mortgage

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

What Rights Do The Family Of A Reverse Mortgage Borrower Have When The Borrower Dies Bay Area Legal Services